Mobile tacos have transformed city corners into vibrant kitchens on wheels. In dense urban markets, a well-run taco truck can become a reliable income source, pairing flavor with steady foot traffic. Industry benchmarks suggest monthly revenue in high-traffic hubs typically ranges from $15,000 to $30,000. After accounting for food costs (roughly 30–35%), labor, fuel, permits, and routine maintenance, net monthly profits commonly fall between $4,000 and $10,000. A 2024 report from The Food Truck Association places the median annual profit for independent mobile vendors around $50,000, though outcomes vary widely by location, pricing, and overhead control. Startup costs can be significant—purchasing a used or custom-built taco truck often sits in the low five figures, with options from suppliers like Qingdao Oriental Shimao illustrating the scale of upfront investment. The takeaways are clear: location, pricing strategy, cost management, and operational efficiency drive results. This article unpacks those factors across four chapters, translating the data into practical guidance for urban commuters, outdoor enthusiasts, small business owners, and first-time pickup buyers.

Profit on the Move: Reading the Real Figures Behind Taco Truck Earnings in Urban Markets

Taco trucks move through city blocks with a rhythm that looks simple from the outside: a compact kitchen on wheels, a bright grill glow, and a queue that forms with the lunch hour. Yet the economics behind those lines of customers are a complex blend of geography, timing, pricing, and discipline. In urban markets, where density and pace collide, the revenue potential can be substantial, but the path to sustainable profit is paved with careful choices rather than luck. The numbers from recent industry analyses paint a usable picture: a well-run taco truck in a high-traffic urban center can generate monthly revenue in the range of fifteen thousand to thirty thousand dollars. That is the top line, the total amount brought in before expenses. The real question, for operators and investors, is what remains after the kitchen is fed, the staff is paid, and the permits are accounted for. By most accounts, net profits hover in a wide band, often cited as roughly four thousand to ten thousand dollars per month in more favorable conditions. But the nuance is essential: those margins hinge on location, menu strategy, operating efficiency, and the scale of the operation. A few sources converge on the figure that margins in urban settings tend to land in a mid-range band—roughly fifteen to twenty-five percent of gross sales. Those percentages translate into real dollars that are easy to underestimate until you map them against parking costs, fuel, and the cost of fresh ingredients that must be kept at peak quality every service window. The reality in 2025 shows why a truck can be a high-stakes asset in the right place and a money pit in the wrong one. The best operators treat a taco truck as a portable restaurant franchise, with the emphasis on speed, consistency, and a menu that travels well under a rotating schedule of neighborhoods, festivals, and office districts. In the most successful cases, urban trucks cultivate a core set of signature items that command premium pricing without sacrificing the speed of service. A dish built on al pastor or carne asada can fetch higher average ticket values when the stall or cart is perceived as delivering authentic, carefully prepared flavors, elevated by house-made salsas and thoughtful portions. Yet the premium pricing must be matched with fast, reliable execution. The kitchen equipment, the layout of the cart, and the flow of the line all contribute to how many customers can be served in an hour. A truck that can serve twenty-five to thirty customers per hour at peak times, with dining speed calibrated to the cadence of a lunch rush, will maximize the top line without triggering a backlog that undercuts service quality. It is not just about the stall’s name or the color of its banners; it is about the sanctity of the operational rhythm. The operator who learns to read a city block—the morning coffee crowd near a finance district, the lunch swell near a hospital campus, or festival foot traffic around a cultural site—builds a schedule that aligns with demand. That alignment, more than any single tactic, determines whether a truck scales profits or merely sustains them. These earnings are not universal. There is a spectrum of outcomes driven by how much a truck can charge for its offerings, how often it can stay in high-visibility locations, and how tightly costs are controlled. A well-lated budget accounts for ingredient costs, labor, fuel, vehicle maintenance, insurance, permits, and licensing. Food costs can drift between thirty and thirty-five percent of sales, depending on the mix of proteins, vegetables, and specialty items, as well as the efficiency of inventory management. Labor is a nontrivial line item in the urban equation. Workers on a mobile kitchen require training to maintain consistency, speed, and safety across constantly changing service windows. Fuel and maintenance add to the monthly burn, especially in cities where municipal regulations demand more frequent checks or more robust mobile kitchen equipment. Permits, licenses, and inspections carry annual or quarterly costs that can vary significantly from one jurisdiction to another. These are not merely overhead; they are the enablers that allow the truck to operate in the most lucrative neighborhoods and at the best events. The operator who keeps a tight watch on these costs—through routine supplier negotiations, preventive maintenance, and careful route planning—can turn what looks like a high-risk venture into a sustainable business. The literature and case studies from 2025 show a striking pattern: in high-traffic urban markets, a taco truck that leverages premium ingredients while maintaining a streamlined operation can capture higher margins, but it must trade on efficient scheduling and disciplined execution. A thoughtful approach to pricing matters as well. Premium pricing for specialty items—whether it is a carefully marinated al pastor, a lean carne asada option, or a house-made salsa that carries a distinctive tang—can lift the average ticket. When the customer perceives value in taste, quality, and authenticity, the price premium translates into proportionally higher revenue without necessarily increasing labor or ingredient costs in the same proportion. At the same time, location economics cannot be ignored. The most successful urban vendors position themselves not just to maximize line length but to maximize market reach. Strategic placement near office towers during lunch hours, or near transit hubs, or at festivals where foot traffic spikes, creates the volume needed to support a strong top line. In practice, this means more than just wandering to the next convenient corner. It involves understanding the city’s pulse, balancing short-term opportunities with long-term location rights, and ensuring that permits and power sources are aligned with a reliable schedule. Efficiency in the kitchen extends beyond the cook’s skill. It is about the entire system: a durable, modular mobile kitchen that can be cleaned quickly, a layout that minimizes movement and congestion, and equipment that stands up to the demands of back-to-back service rounds. The choice of chassis and the reliability of the platform itself matter. A mobile unit built on a robust chassis—such as those designed on a standard van or light truck platform—can deliver consistent performance through urban routes and long shifts. When a truck is able to operate in a steady cycle, the cash flow becomes more predictable, which in turn supports more confident financing and growth planning. In some cases, asset maturity translates into staff development, with experienced crews that can work efficiently under pressure and adapt to new menus or seasonal specials. This is where the discussion drifts into startup costs and the broader financial picture. The preliminary investment for a fully equipped taco truck can range from fifty thousand to a hundred thousand dollars, depending on whether the vehicle is used or custom-built and how much interior fit-out is required to accommodate regulatory standards and high-volume output. Some sellers in the market advertise low-cost shells or used units that can be transformed into fully functional kitchens, with initial prices that appear surprisingly affordable. It is essential, however, to approach those numbers with a clear plan for return on investment. The faster the operator can reach a sustainable monthly profit, the more attractive the asset. A related consideration is the ongoing capital expenditure that accompanies growth. As a truck expands service windows or adds more crew members, the business may need to invest in more vehicles, new permits, or upgraded equipment to handle increased demand. This is where a prudent operator will map cash flow across several quarters, ensuring that the seasonality of city life does not lull the business into a cash crunch. The urban advantage, when harnessed with discipline, is not just about the license to serve more tacos; it is about the license to capture more customers at moments when they are most ready to buy. The narrative here is not simply market size but market velocity—the speed with which a truck can attract customers and convert that traffic into reliable income. The more consistent this velocity, the more predictable the revenue, and the more confident the operator becomes about scaling. There is also value in specialization. Some vendors build reputations around a signature dish or a distinctive set of flavors that becomes a city talk. While it can require an upfront investment in specialized equipment or consistent power supplies for rotating spits, these investments often yield strong loyalty and repeat business, especially in festival circuits and cultural neighborhoods where authenticity is a differentiator. In such contexts, the price premium is not just about the dish; it is about the brand promise—the identity of a truck as a mobile culinary destination rather than a simple vendor. The numbers support this view, even as they remind us of the risk that a misaligned strategy can pose. For a truck focusing on accessible, high-volume sales, monthly revenue can reach the higher end of the spectrum, with margins that press toward the upper quarter of profitability. For a truck leaning into premium pricing and a curated menu, revenue can be similar, but margins may stretch due to better ticket values, provided costs are controlled. Across this spectrum, the net profit picture—whether pegged at four thousand dollars or more toward seven thousand or eight thousand in favorable conditions—depends on the operator’s analytic discipline. A careful balance of procurement, labor scheduling, and route planning is the difference between a story of modest success and a narrative of consistent growth. The broader market context, including regulatory environments and access to capital, also matters. Industry associations and government resources emphasize the importance of compliance, proper licensing, and safety standards. They remind us that the dream of a thriving urban taco business is not built on luck but on a framework of permits, inspections, and ongoing financial discipline. The economic logic supports a pragmatic view: urban markets amplify demand, but they also impose costs that must be anticipated, tracked, and managed with precision. For operators who want to make the most of this urban advantage, collaboration with suppliers, disciplined inventory practices, and a prioritized calendar of high-traffic locations become essential tools. In the end, the question of how much a taco truck makes in urban markets answers itself through the daily choices of the operator: where to stand, how to price, how fast to move the line, and how tightly to control costs. The enterprise is, in effect, a case study in portable retail energy, where location, timing, and practice converge to determine the bottom line. Those who invest in robust kitchen equipment, strategic location planning, and a menu that resonates with local tastes can transform a street-food concept into a durable urban business. While startup costs and city-specific regulations will shade the math, the underlying truth remains clear: with the right mix of speed, menu, and location, a taco truck in a bustling city can be a viable path to meaningful earnings, not merely a seasonal sideshow. For readers seeking practical steps toward sustainable profitability, consider integrating the lessons of sustainable practices for mobile food trucks into daily operations and analytic planning, which can help align cost controls with revenue opportunities over time. Learn more about how a disciplined approach to operations can reinforce profitability by visiting resources that focus on long-term efficiency and resilience in mobile food ventures. https://pockettacotruck.com/sustainable-practices-mobile-food-trucks/ The broader context of urban food entrepreneurship is fruitful when explored alongside ongoing analyses of market dynamics and policy developments. For a global perspective on how urban markets influence earnings and strategy, one can also review comparative analyses from reputable outlets that examine the evolving landscape of mobile food businesses. As with any venture that rides the waves of city life, the most reliable conclusions come from a steady cadence of data, experimentation, and careful cost management. A comprehensive set of insights for operators, especially those navigating the overlap of high demand and tight margins, can be found in industry reports and government guidance that describe how to budget, price, and schedule effectively. To widen the lens beyond the local block and into broader narratives of urban profitability, the earnings picture in 2025 reflects a mix of tradition and adaptation: the traditional quiet of a well-tuned kitchen, paired with the modern tempo of city street commerce. The result is a dynamic balance where a taco truck can be a meaningful income source, sometimes a small business lifeline, and at times a scalable enterprise. The key is to treat the venture as a living system—one that responds to the city’s rhythms with data-driven decisions, disciplined financial management, and a menu designed for flavor and speed. External considerations, including macroeconomic trends and shifts in consumer dining preferences, will continue to shape the math, but the core structure remains consistent: revenue in the urban setting tends to be robust when demand is high, costs are controlled, and the vehicle is part of a well-planned growth trajectory. For readers who want to see how these pieces come together in practice, delving into the latest reports and case studies can provide a more concrete roadmap to profitability on the move. External resources and ongoing research offer further depth on how value is created in this space, helping owners translate city energy into sustainable earnings. External reading: https://www.aljazeera.com/insight/2025/12/28/taco-trucks-urban-markets-earnings-analysis

Toward Profit on a Tasty Route: The Cost Structure, Efficiency, and Real Math Behind Taco Truck Profits

Profit in the taco truck world is a rolling calculation. It depends on location, pricing, customer flow, and how well costs are controlled. In urban markets, monthly revenue can range from tens of thousands to six figures, with net profit often in the low to mid double digits as a percentage of revenue after cost of goods sold, labor, fuel, permits, and depreciation. Core costs include food costs around 30 to 35 percent of sales, labor costs that scale with staffing and shifts, and fixed overhead such as permits, insurance, maintenance, and vehicle depreciation. Startup costs vary widely depending on whether the unit is used or new, equipment, refrigeration, and compliance, but should be planned with a cushion for unexpected repairs. Pricing strategy should align with market demand and value perception, balancing price with throughput. Equipment choices manual vs automated impact labor efficiency, throughput, and margins, and must be weighed against upfront cost and maintenance. A disciplined approach combining inventory control, waste reduction, and data informed pricing can improve profitability, with margins potentially in the high teens to mid twenties percent in well run operations. The ROI on technology upgrades depends on measurable gains in throughput and labor savings, and is most viable when the business model can absorb the upfront investment. External factors such as industry benchmarks can offer guidance, but the practical path is to forecast demand, track costs, and test pricing in the local market.

From Sizzle to the Bottom Line: Navigating Startup Costs, Financing, and Break-even for a Taco Truck

The dream of a taco truck often starts with the scent of peppers, the sound of a grill kicking to life, and a belief that flavor can travel. Yet behind that sizzle lies a measurable arithmetic that every operator must learn to respect. This chapter threads together the practical math of starting and sustaining a mobile taco business, showing how the price of ambition meets the realities of startup costs, financing options, and a realistic path to profitability. In many markets, a well-run taco truck can generate meaningful revenue, but the margin for error is small and the timing is everything. A clear-eyed view of the financial pieces helps would-be owners avoid overreach while still leveraging opportunity, improvising where needed and executing with discipline where it counts.

Revenue in the taco-truck world tends to ride on location and pace. In high-traffic urban environments, a truck can bring in substantial gross sales each month—roughly in the range of fifteen thousand to thirty thousand dollars. That figure, while reassuring, paints only the surface of the picture. After covering food costs, labor, fuel, permits, and ongoing equipment maintenance, the real prize becomes the net profit, which industry observers often place in a broad band, typically four thousand to ten thousand dollars per month for a well-managed operation. The range reflects not just how many tacos are sold, but how a operator designs the menu, structures pricing, and controls costs. A truck that targets premium ingredients or specialty bites in a tourist-heavy corridor may see stronger margins, while one in a neighborhood with tighter buying power may need to push volume to achieve the same profitability. A broader view from industry reports adds context: the median annual profit for independent mobile food vendors in the United States sits around fifty thousand dollars, though, as with any small business, the spread is wide and closely tied to location, operations, and owner skill.

Putting these numbers in motion requires a starting line that is anything but cheap. Startup costs for a fully equipped mobile taco operation typically sit between seventy-five thousand and one hundred fifty thousand dollars. This headline figure breaks down into tangible components. The vehicle itself—whether a used, well-maintained mobile kitchen or a purpose-built truck—constitutes roughly forty thousand to eighty thousand dollars. Inside, kitchen gear runs about fifteen thousand to thirty thousand dollars; this includes grills, fryers, refrigeration, sinks, and the necessary storage. Permits and licenses, a vendor’s passport to operation, usually run around one thousand to five thousand dollars, depending on city and state rules. Branding and signage add another two thousand to five thousand dollars, and initial inventory and supplies around three thousand to seven thousand dollars. The end result is a package designed for rapid deployment, but it carries a significant upfront cash hurdle that forces careful planning and forecasting.

For many aspiring operators, the numbers become more tractable when exploring lower-cost alternatives. Pushcarts or repurposed vans can slash startup costs to roughly twenty thousand to forty thousand dollars. That choice dramatically changes the business dynamics: less upfront risk, but proportionally fewer menu options, smaller cooking footprints, and a different scale of daily revenue. The trade-off is a decision about risk tolerance, appetite for rapid growth, and the degree to which a founder wants to invest in a brand that can grow from a single truck to a regional footprint.

Financing the venture is the next critical hinge. Lenders naturally want to see a plan, but the challenge for a mobile-food operation is the absence of traditional collateral tied to a brick-and-mortar restaurant. Yet several financing avenues exist, each with its own pace, terms, and expectations. Government-supported small-business programs provide entry points that recognize the unique risks of a startup and the mobile nature of the business. Microloans and larger SBA-backed loans can cover substantial portions of the upfront cost, with terms designed to be manageable for a new operator. These programs typically include flexible terms and amortization that align with the cash cycle of a food business, though the application process can be rigorously documented and time-consuming.

Beyond government-backed options, there are alternative lenders that move a bit faster, offering quicker decisions and lighter documentation, albeit sometimes at a higher price. Some operators fund part of the venture with personal savings or contributions from family and friends, a common path that reduces external financing dependence. Crowdfunding offers another avenue, not only to raise capital but also to build early community support and a customer base that can be activated at launch.

Financial projections often skewer optimism with reality, but they are not meant to dampen ambition; they are a map. In industry terms, the average loan size for small food-service ventures sits around the six-figure mark, with interest rates typically described as a range rather than a single number. Loans may range from micro support in the tens of thousands to larger sums that cover the bulk of the vehicle and equipment costs. The precise terms depend on credit history, business plan quality, and the lender’s appetite for a mobile concept. The overarching takeaway is that financing legitimacy comes not just from money, but from a credible plan: a realistic budget, a well-researched route to customers, and a transparent strategy to manage cost of goods and operating expenses.

Holding the line on costs once the truck is rolling is where profitability begins to crystallize. A practical break-even projection for a taco truck is generally in the vicinity of twelve to eighteen months, assuming consistent daily sales and disciplined expense control. The pace of break-even hinges on how aggressively the truck can sell—roughly a thousand to fifteen hundred dollars in daily sales accelerates the path to profitability, whereas a seven-hundred-dollar day stretches it. The receipts of the operation must be weighed against fixed costs that persist regardless of sales—lease or loan payments for the vehicle, insurance, fuel, and staff wages—alongside variable costs tied to the ingredients, packaging, and incidental supplies. Seasonal shifts and location play a powerful role. In high-demand urban cores like major food markets or festival-heavy neighborhoods, demand can remain buoyant and help shave weeks or months off the time to profitability. In more rural or lower-traffic zones, the path becomes longer, and owners must lean more on volume, clever scheduling, and capital discipline.

The broader profitability picture, when a truck truly reaches steady-state operations, often resembles a classic small-business arc. Industry references point to annual revenues in the range of two hundred to three hundred thousand dollars for a successful food truck, with net profit margins in a modest band—typically around ten to fifteen percent after all expenses. In practical terms, that translates to roughly thirty thousand to forty-five thousand dollars of annual net income once profitability is established. Those figures are not universal, but they illustrate what is possible when the business scales responsibly, price points reflect value, and costs stay disciplined.

All of this points to a few pragmatic truths. First, a taco truck’s financial destiny hinges on a careful blend of pricing strategy and cost control. The food-cost percentage—often cited as roughly thirty to thirty-five percent of sales—deserves constant attention. It is not only a metric; it is a lever. Small shifts in supplier pricing, waste reduction, and portion control can translate into meaningful improvements in the bottom line. Second, success is inseparable from location strategy. A truck that anchors itself near high-foot-traffic venues, or that follows event calendars and popular lunchtime corridors, will outperform a stationary, generic route. The third lever is branding and customer experience. People buy not just a taco, but a story, an atmosphere, and a sense that the truck is a reliable, friendly presence in their everyday life. That alignment with customer expectations reinforces repeat visits and word-of-mouth referrals, which in turn support healthier price realization and steadier daily volumes.

The journey from startup to break-even and beyond is rarely a straight line. It is a process of setting expectations, building a plan, and then executing with flexibility. The narrative of a taco truck is built on the discipline of budgeting, the prudence of financing, and the ambition to craft flavors that keep customers coming back. A realistic approach acknowledges that success is not a one-time sign of a good day’s sales; it is the cumulative effect of many days with strong execution, careful stock management, and an ability to adapt to shifting markets and seasonal rhythms. It also means recognizing that the costs of operation extend beyond the obvious line items. Maintenance of equipment, periodic repairs, and the ongoing need to invest in branding and compliance all demand ongoing attention. In short, the bottom line is earned through a combination of taste and discipline, a partnership between culinary craft and business acumen.

For practitioners who want to weave this practical framework into their planning, the experience often begins with a clear, conservative budget and a staged financing plan. It’s common to structure a ramp-up that aligns with the truck’s first few months of operation, gradually increasing daily sales expectations as the brand gains visibility and as routes are optimized. A sound ramp plan helps avoid early cash-flow crunches and sets the stage for steady reinvestment in better equipment, more efficient routes, and more attractive menu options. It also creates a habit of measuring the right things: waste per day, yield per dollar of sales, and the correlation between peak hours and profit per taco. When a truck owner treats these metrics as a continuous feedback loop, the business starts to look less like a gamble and more like a sustainable venture that can scale.

In the spirit of practical implementation, consider the bridge between the dream and the daily grind: the philosophy that you are selling more than food; you are selling a temporary, portable experience that travels with your customer from a quick lunch to a weekend stroll. That social currency—the sense of reliability, warmth, and consistent value—can be as decisive as a perfectly seasoned carne or a crisp, fresh shell. When healthful operations and compliance are part of the backbone, the business not only survives; it earns trust. That trust translates into customers who seek you out by name rather than simply by taco, and in a market where many options exist, such loyalty can be the difference between a good year and a great one.

If you want to take a deeper dive into the practical side of sustainable, scalable operation, a resource on sustainable practices for mobile food trucks offers concrete guidance on waste reduction, energy use, and efficient workflow that can support both cost control and brand integrity. See sustainable-practices-mobile-food-trucks for guidance on reducing waste and improving efficiency. This kind of operational lens complements the financial map by addressing the everyday realities of a truck on the street and in the kitchen, helping to ensure that growth is not just measured in dollars but in durable capability.

As you map your own path, remember that the numbers are a starting point, not a destination. The real value comes from translating them into a disciplined plan—one that accounts for the realities of permits, insurance, and ongoing costs; leverages opportunities in high-traffic locales; and uses careful menu design and customer engagement to improve margins over time. A taco truck is a portable business, but its success is anchored in stability: consistent sales, controlled costs, and a steady strategy for reinvestment. When these pieces align, the journey from sizzle to bottom line becomes a practiced, repeatable cycle rather than a one-off triumph. Your truck becomes more than a mobile kitchen; it becomes a recognizable, trusted presence in the community, a machine that can turn a flavorful idea into a reliable economic outcome.

External resource: https://www.sba.gov

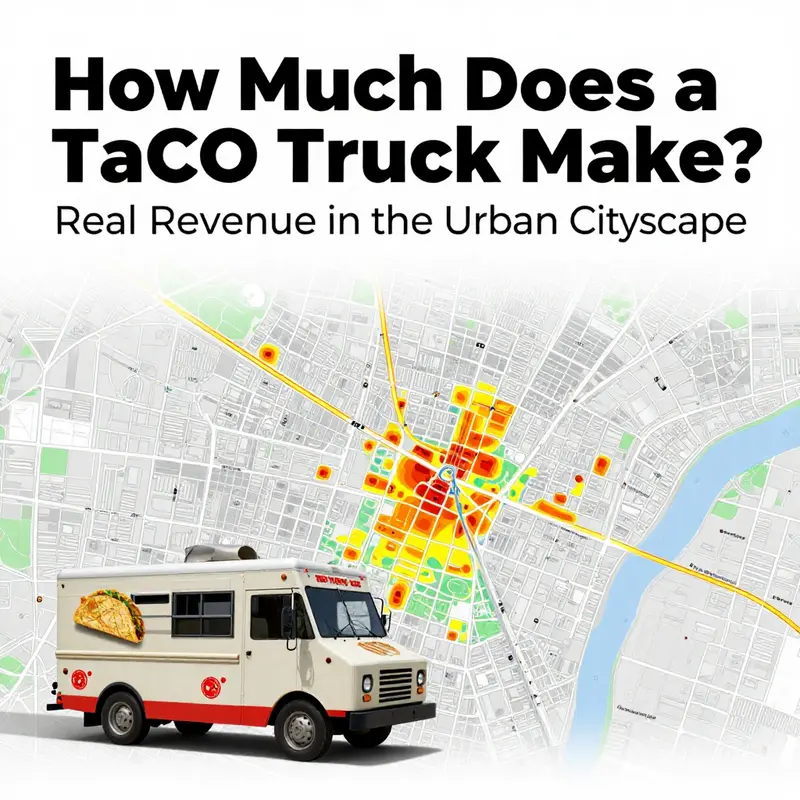

Geography, Demographics, and the Taco Truck Payoff: Reading Revenue Signals Across Streets and Neighborhoods

Revenue from a taco truck is seldom a single number. It is a living signal of the places where people work, study, socialize, and decide to spend a few minutes away from home. The core idea is simple: location determines visibility, street-level demand, and pricing leverage. A truck parked near a bustling business district at lunch can move more meals in an hour than a one parked on a quiet side street. But the story is more nuanced than foot traffic alone. It is a blend of the place, the people who inhabit it, and the rhythms of daily life that govern when and how often customers show up. In many urban markets, a well-managed taco operation can generate meaningful revenue— figures that industry observers commonly cite as between roughly fifteen thousand and thirty thousand dollars in monthly sales for a high-traffic position. Those numbers sound straightforward, yet they hinge on a tight alignment of several moving parts: the price point, the menu mix, the speed of service, and the efficiency of the supply chain that keeps the line moving without letting waste or spoilage derail profits. After costs—food costs that typically run around thirty to thirty-five percent of sales, plus labor, fuel, permits, and maintenance—the take-home reality tends to be more modest. Net monthly profits of roughly four thousand to ten thousand dollars emerge when overhead is kept disciplined and when the operator can sustain consistent demand through the busy windows of each day. This financial picture is not a guarantee, of course, but it provides a baseline from which operators can calibrate expectations as they test different sites and seasons.

The geographic angle is not merely about city size. It is about the density of a place’s everyday life: where people move from morning to night, where lunch-hour crowds gather near offices or campuses, and where after-work or late-night energy concentrates around theaters, stadiums, or nightlife districts. A truck serving premium ingredients or a chef-driven street menu might be able to command higher prices and enjoy margins that exceed the typical range, simply because guests perceive a higher value per item. By contrast, a high-volume model in a neighborhood with fewer discretionary dollars may rely on a broader footprint and faster turnover, chasing small per-unit margins but compensating with volume. The geographic framework matters more when it is coupled with a thoughtful menu that matches local tastes, as well as a branding approach that signals reliability and personality in a crowded street-food landscape. The frequency and predictability of demand—how often customers expect the truck to be present and at what times—often determine whether a route achieves steady cash flow or a cycle of feast and famine.

Demographics provide a second, highly influential lens. Age composition frequently matters as much as income levels. Areas with a larger share of younger residents—typically those in the eighteen to thirty-four bracket—tend to display stronger street-food demand. Younger populations are more open to casual dining formats and new culinary experiences, and they often operate with flexible spending patterns that tolerate quick, flavorful meals on the go. That openness can translate into higher impulse purchases during lunch breaks or evening strolls through popular neighborhoods. Income levels also shape revenue potential. In regions where median household income is above the national average, customers tend to spend more per visit and might be more willing to try innovative or premium items. This doesn’t mean price is the sole determinant of success; it means price, value perception, and menu alignment must reflect the purchasing power of the local market.

Ethnic and cultural makeup adds another layer of resonance. A strong Hispanic or Latin American presence nearby can correlate with higher acceptance and repeat business for taco-focused offerings. Even in diverse urban settings, neighborhoods with a robust culinary memory or preference for authentic flavors can reward operators who listen to taste preferences and deliver consistent quality. A culturally diverse environment is often an advantage for a truck that can flex its menu—offering regional specialties or rotating items that celebrate different heritages—without sacrificing core favorites that anchor the brand.

Urban centers with dense foot traffic create the most predictable revenue streams, especially when the truck is placed near mass transit hubs, office corridors, university campuses, or event-rich zones. The proximity to work clusters means a reliable lunch crowd, while entertainment districts can generate after-hours traffic. The pattern is straightforward: more daily bodies passing in front of the truck equals more chances to convert a passerby into a customer. In such environments, the typical lunch window becomes a reliable revenue artery, and well-timed late shifts can capture the appetite of people leaving venues or heading to social spaces after work. Yet density alone does not guarantee profit. A crowded market can breed fierce competition, which raises the bar for differentiation. A truck must stand out through its branding, speed, and the perceived value of its menu—whether that means speed of service, authenticity, or the use of distinctive ingredients.

Rural or less-dense areas pose different challenges. The audience is smaller, so per-day revenue can be lower, and the operating model may need to lean more heavily on events, partnerships, and seasonal opportunities to stay in the black. In such settings, visibility becomes a strategic asset. A well-timed presence at fairs, farmers’ markets, or local festivals can create a spike in demand that sustains the business between longer, steadier cycles of street traffic. For this reason, many operators adopt hybrid models—a steady, city-based route with occasional detours to community gatherings—so they can capitalize on niche moments without losing the rhythm of daily operations.

The competitive landscape also matters. Areas with crowded food scenes may create demand fragmentation as customers sample multiple trucks. In those markets, success hinges on a few differentiators: consistency in menu quality, a clear value proposition, and a dependable schedule. Reliability matters as much as flavor. People come to expect you in a certain place at a certain time; when you show up, they trust the experience to be good and familiar. Branding, too, plays a central role. A strong, memorable identity helps a truck cut through the noise and evokes a sense of belonging. A recognizable name or visual motif can become a signal that draws customers back—not just for a single dish but for an entire habit around lunchtime or after-hours cravings.

All of this has practical implications for site selection. A data-driven approach to picking locations can elevate the odds of a positive revenue outcome. Start by gathering local demographics: age distribution, income, ethnicity, and population density. Combine that with a sense of daytime versus evening foot traffic: where do people commute, work, study, and unwind? The goal is to map zones of high and consistent demand, then test those zones with short-term deployments to see how real-world behavior compares to projections. A pilot phase serves as a practical feedback loop, revealing the price sensitivity of the audience, the speed at which a crew can serve customers, and the true cost of permitting and parking in a given area.

Community dynamics also matter. In culturally aligned neighborhoods, offering authentic or locally resonant items can drive repeat business and referrals. The social ecosystem around food trucks—events, markets, and partnerships—also has a measurable impact on revenue. The value of partnerships should not be underestimated. A truck that links with local employers for lunch programs, or with universities for campus events, can stabilize revenue by creating predictable streams. The more a truck becomes a familiar part of the local dining landscape, the more it can leverage relationships to secure prime slots and extended hours during peak periods. This is where a broader sense of community, beyond mere traffic counts, starts to pay off—genuine relationships translate into recurring revenue opportunities and a smoother path to profitability.

From a financial planning standpoint, the economic backdrop to location choice remains critical. Startup costs for a taco truck, whether a used model or a custom-built vehicle, can be a meaningful consideration. Outside investors or personal capital are often weighed against the speed of return. A used or modestly upgraded truck might sit in the range of several thousand dollars, while a fully equipped, purpose-built unit can represent a larger capital outlay. The important point is to calibrate the purchase and retrofit plan to the location strategy. A vehicle that is parked in a high-demand area but has reliability problems or insufficient storage space for ingredients and equipment can erode margins quickly. Conversely, a truck that is well-maintained, easy to clean, and designed for rapid service can turn a favorable location into consistent cash flow.

The strategic implication of this geography-driven approach is simple: test, learn, and adapt. Data-driven location analysis helps identify prime operating zones, but the real test occurs when you deploy a truck in those zones and observe actual demand. The cost structure—food costs, labor, fuel, permits, and maintenance—will behave differently depending on location. In high-cost urban neighborhoods, premium pricing and a curated menu can sustain higher margins, but you must maintain high service quality to justify those prices. In more price-sensitive areas, speed and volume become the main engines of profitability. The best operators build flexibility into their model—adjusting hours, rotating through neighborhoods with complementary demographics, and refining their menu to align with local tastes and seasonal trends.

The conversation around site selection also benefits from a practical, reproducible framework. Start with data: collect local demographics and map daytime versus evening crowds. Then assess the competitive landscape: how many trucks and other food options are nearby, and what are their price points and menus? Build revenue scenarios by estimating daily sales, average check size, and a capture rate that reflects the truck’s share of the nearby audience. Run sensitivity analyses for different days of the week and events. Validate your projections with short pilots in top candidate areas. Track daily revenue, costs, and customer feedback to refine the route and the hours. Align your route with community tastes and partnerships, then tune your schedule to maximize the hours when demand peaks.

The moral of the geographic and demographic story is that revenue potential is not a universal constant. It is a function of place, people, and the moment. A truck that understands and responds to the specific rhythms of a neighborhood—its age profile, its income reality, its cultural fabric, and its daily pulse—will consistently outperform a similarly priced truck that treats every location as interchangeable. The “how much” question thus becomes a question of where and when, as much as it is a question of what is on the menu. This is why many operators begin with a careful, local market assessment before they purchase a vehicle or lock in a routine. They translate the intangible sense of place into a concrete set of numbers—expected daily traffic, average spend, and the probability of repeat visits—that can guide the planning of hours, locations, and staffing.

Beyond the math, there is a social dimension to revenue that deserves attention. Street food thrives at the intersection of mobility and community. A truck’s success grows when it becomes a familiar and welcomed part of daily life, not merely a temporary stop. That is why many operators develop a philosophy around reliability and service. Showing up on time, serving consistently, keeping the line moving, and maintaining cleanliness in a visible way all reinforce trust. In turn, trust translates into repeat customers who know where to find the truck, what to expect, and how to judge the value they receive. The geography of profit, then, is as much about the social geography of a neighborhood as it is about occupant demographics. The most durable revenue engines are those that couple a strong location strategy with a strong community presence—events, partnerships, and a brand that people associate with quality and reliability.

As with any small business, the cost and revenue calculus is layered. Startup costs, ongoing operating expenses, and location-based pricing all interact. A truck in a dense urban core may command higher prices and benefit from volume, but it also faces higher permits, parking fees, and labor costs. A rural or suburban route might enjoy lower overhead but require a more aggressive approach to marketing, partnerships, and event participation to sustain daily sales. In every case, the underlying truth remains: revenue is a function of how well the truck harnesses place and people into a reliable daily routine. When operators calibrate their menu, price, and schedule to the specific geography and demographics of their target area, they build a business that is less at the mercy of random foot traffic and more anchored in predictable patterns. This is the core reason why the geographic and demographic lens is essential to understanding how much a taco truck makes and how to optimize that outcome over time.

For readers who want to explore real-world illustrations of this approach, the literature on taco truck revenue and site-selection emphasizes how much of the outcome hinges on knowing the neighborhood and its rhythms. The takeaway is not a single magic formula, but a disciplined process: map the people and the place, pilot with intention, learn quickly, and adapt with humility. In practice, this means operators should prioritize data gathering about local age structure, income distribution, and cultural trends, then pair those insights with a deliberate decision to test multiple sites before committing to a fixed route. It also means honoring the social dimension of street food—building relationships with employers, students, organizers of events, and neighborhood associations so that the truck becomes a trusted, valued part of the community rather than a transient visitor. With this approach, the numbers on a balance sheet begin to reflect the true potential of the locale, and the path from street corner to sustainable profitability becomes more clear. The story of geographic and demographic influences on revenue is not just about where people are; it is about how, through careful listening and responsive operation, a taco truck earns its keep where the city’s everyday life unfolds.

And when it comes to practical steps for operators seeking to translate these insights into action, a few anchors help. First, invest in a robust data approach to identify and compare promising zones. Second, run short, controlled pilots to test demand and price sensitivity. Third, design for service speed and reliability so customers feel they are getting consistent value, not just a quick bite. Fourth, cultivate local partnerships that create recurring revenue channels—lunch programs, campus events, and community markets. Fifth, maintain a lean but adaptable cost structure so margins stay resilient as demographics and competition evolve. These steps do not guarantee a fixed number, but they increasingly tilt the odds toward a stable, growing revenue stream rather than a volatile, one-off sales burst. In the end, the geographic and demographic dimensions are not mere background color; they are the scaffolding that supports a taco truck’s ability to monetize street life with clarity and steadiness.

For readers who want to go deeper into the topic with a broader industry perspective, a published piece from 2023 addresses the revenue dynamics and location-driven considerations in food trucks, offering data-backed insights and practical guidance. External resource: https://www.foodbusinessnews.net/articles/2023/05/16/taco-truck-revenue. And for a tangible example of how communities can rally around mobile food opportunities, see how local initiatives link trucks with community needs at Trucks for Change—Community Support Initiatives.

Final thoughts

Across urban streets, profitability hinges on the basics: a hungry crowd, a compelling menu, steady costs, and disciplined operations. Urban markets can deliver strong revenue streams, but the margin story is about more than daily sales. By understanding cost structure, securing favorable startup terms, and aligning location with audience, operators can push toward the higher end of the potential—often achieving meaningful monthly profits even in competitive city landscapes. For first-time buyers, the numbers here translate to a practical checklist: validate location, price thoughtfully, optimize waste, and plan for the long run. The city rewards operators who blend flavor with efficiency and location savvy.