City sidewalks light up as taco trucks roll into neighborhoods, offering a quick bite for commuters, hikers, freelancers, and curious first-time buyers. Payment options have become as important as the toppings—do taco trucks take card? The answer isn’t universal, and it changes by block, city, and platform. Cash remains common among smaller trucks and pop-ups, but many operators in busy corridors and on delivery apps now offer debit and credit card payments. Digital wallets, mobile apps, and card readers mounted at the window speed service and reduce the need to juggle coins. For city dwellers who rely on transit, late shifts, or impromptu outdoor adventures, card acceptance can be a deciding factor when choosing a lunch stop. This piece follows five threads to help urban commuters, outdoor enthusiasts, small business owners and freelancers, and first-time pickup buyers understand what to expect, how to verify options, and where changes may be headed. We’ll explore the current landscape, economic implications for operators, technology choices, regional differences, and emerging policy and trend signals that could reshape a cashless street-food reality.

Chapter 1: The Card-Ready Street Cart — Mapping the Do Taco Trucks Take Card Landscape

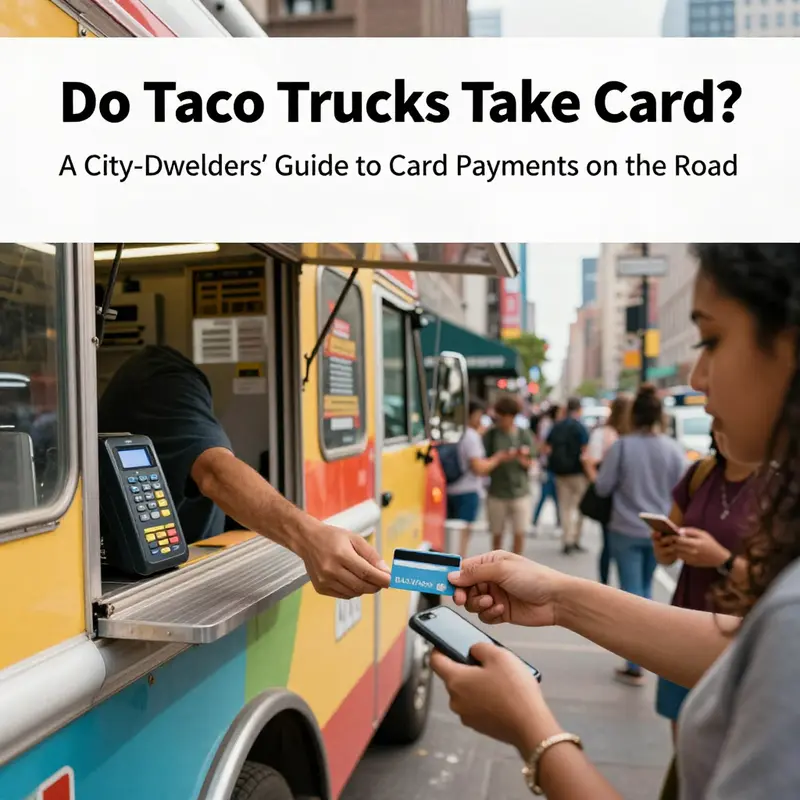

On street corners, markets, and festival grounds, the question of whether taco trucks take card has shifted from a quirky aside to a baseline expectation. Customers arrive ready to pay with a card or a tap, not to fish for cash. The movement is not a fad but part of a broader trend sweeping small, mobile vendors toward the same digital payment norms seen in stores and eateries across the country. The result is a more inclusive and efficient experience for diners who value speed, security, and the gentler handling of cash and coins that comes with plastic and digital wallets. In practical terms, the current landscape has become a map of options rather than a simple yes or no. Operators who once relied solely on cash now face a spectrum of possibilities, from fully card-enabled stalls to cash-first setups that still honor the realities of certain neighborhoods, events, or technical hiccups. This diversity matters because it shapes how people decide where to eat, how quickly they can settle a meal, and how much they end up spending when line lengths grow longer during peak hours. The broader shift toward digital payments reflects a simple triad of consumer expectations: convenience, speed, and trust, all of which are magnified when the setting is a mobile kitchen that may park in a crowded lot, a street fair, or a pop-up at a neighborhood block party. The numbers behind this shift are telling. Recent data from the Federal Reserve and major payment networks reveal that more than eight in ten point-of-sale transactions in the United States are digital, and contactless methods now account for a substantial share of those digital transactions. For taco trucks, this means a growing likelihood that a customer can settle a bill with a tap or a wave rather than counting coins. The convenience of card and digital wallets translates directly into shorter line times and happier repeat customers who do not have to choose between paying and preserving time for the next dish. Digital wallets, while not universal, have become standard fare at many mobile food sites. They offer speed and a layer of security through tokenization, which means actual card numbers are not exposed during the transaction. While the rise of these methods is clear, the landscape is not monotone. Cash remains in the mix, especially in neighborhoods where connectivity is spotty or where customers prefer cash for everyday microtransactions. The Federal Reserve’s data put cash transactions at a minority share, but not an extinct one, underscoring that the payment mix remains nuanced rather than uniform. For the truck operator, that nuance matters. It means balancing the reliability of card readers with the resilience of cash options, particularly during festivals or outdoor events where a dense crowd can tax a single point-of-sale setup. The practical takeaway is that the most successful taco trucks are those that offer a reliable card-reading capability while maintaining at least a simple cash option, thereby reducing the risk of losing sales when a customer arrives without cash or when a connection momentarily falters. The force of this trend is amplified by the infrastructure behind it. Portable card readers have become compact, durable, and surprisingly quick at processing transactions, even in less than ideal weather or variable signal conditions. For many operators, the decision to deploy these tools is less about embracing a technology novelty and more about meeting customer expectations and capturing additional sales that would be lost to cash-only competitors. In this sense, the card-ready street cart becomes a competitive advantage, not a mere convenience, particularly during events that attract large crowds and a diverse mix of patrons. The adoption of card payments also aligns with consumer behavior changes that extend beyond tacos. Surveys and industry analyses consistently show that a growing share of consumers prefer to use digital wallets for everyday purchases, including street food. The appeal lies in the speed of checkout, reduced exposure to handling cash, and a sense of modernity in the purchase experience. Moreover, some truck operators are quietly experimenting with more flexible payment options, including split-tender arrangements and wallets that support quick, low-value transactions. Even though BNPL options remain less common in the street-food sector, early experiments indicate that when a customer plans a larger order or a festival-sized meal, a payment plan or installment option could be attractive. While such offerings are still in their infancy for mobile vendors, the potential to broaden the customer base during peak events is a strong incentive for operators to watch this space and to partner with fintech platforms that can deliver simple, secure arrangements without complicating the transaction flow. Yet the story is not only about technology; it is about the people who use it. For many customers, the choice to pay by card is a statement about the ease of doing business with the vendor. It signals that the vendor has invested in a reliable checkout experience, which in turn lowers the perceived risk of ordering from a truck that might otherwise seem too casual or too remote to trust with a digital transaction. The social signaling is powerful: a well-lit, clearly posted sign indicating card acceptance can reassure a first-time visitor that the experience will be smooth. And that sign, whether on a chalkboard menu or a small placard, matters more than people might assume because it confirms a standard customers expect in a modern, mobile dining environment. To make this transition work in practice, many operators have learned the importance of signage, network reliability, and a straightforward flow from order to payment. Quick, seamless payment flows reduce the chance of bottlenecks, which in turn improves tips and repeat visits. In markets where street-food culture thrives, the best-performing trucks have learned to design a checkout path that mirrors the pace of a busy kitchen: a clear call for the next customer, a fast scanner or reader process, and an unobstructed path to collect the receipt or digital confirmation. The operational implications extend beyond the cash register. A vendor who can process card payments efficiently often can scale up to larger events with greater confidence, because their checkout can handle larger volumes without a drop in speed or a surge in errors. This operational agility matters when a truck moves from a quiet inner-city corner to a festival ground where demand spikes by the hour and the pace can be brutal. An intuitive, reliable payment experience helps maintain consistent customer satisfaction across the entire day. While the current landscape is undeniably digital, it is important to remember how signs of evolving payment habits feed back into the street-food ecosystem. The growing expectation for card acceptance and digital wallets pushes organizers of pop-ups and festivals to provide robust payment options at multiple stalls and booths. This, in turn, creates a network effect: the more trucks that accept cards, the more customers come ready to pay with cards, which encourages even more trucks to adopt card-readers and digital receipts. And when customers travel and rely on a familiar payment gesture—tapping a card or waving a phone—the friction of paying becomes almost invisible, allowing them to focus on flavors, not form. For operators seeking a practical entry point into this landscape, the emphasis should be less on chasing a particular brand of reader and more on ensuring consistency, security, and accessibility. A portable, compliant reader that can operate with minimal downtime—paired with clear signage and a reliable method to handle edge cases—will likely deliver the strongest returns. The social and economic benefits flow in tandem. Customers enjoy faster service and lower transaction costs, while operators gain greater control over sales data and inventory planning, since digital transactions are easier to track, reconcile, and analyze for future events. There is also a broader cultural shift to consider: the integration of sustainable practices with digital payments. As mobile vendors refine their operations, they often pair card acceptance with responsible waste management, energy-efficient equipment, and transparent pricing. For operators exploring how digital payments fit into a broader shift toward sustainable, tech-driven operations, sustainable-practices-mobile-trucks provides context on how digital payments intersect with broader operational improvements. In this evolving scene, the core question—do taco trucks take card?—has become a starting point for a larger conversation about accessibility, efficiency, and trust on the street. The consensus among industry observers and seasoned operators is that cards and digital wallets are now a substantial majority option, even as cash remains a contingency. The payoff is clear: when a truck accepts cards, it removes a point of friction for a broad range of customers, accelerates the dining experience, and positions the vendor to participate in a wide array of events and sales channels. Yet this is not a universal rule, and the best approach for a given truck is to assess local conditions, customer demographics, and the specific contexts in which it operates. The current payment landscape is overwhelmingly digital, but the exact mix is still shaped by geography, event type, and the vendor’s readiness to invest in reliable, secure, and scalable payment solutions. For consumers, the message is straightforward: when you see a sign that reads We Accept Cards, you are likely stepping into a modern, efficient street-food experience. For operators, the takeaway is pragmatic: adopt dependable card-reading capability, maintain a cash option for safety and inclusivity, and communicate clearly about payment methods to prevent disappointment. And for the broader industry, this evolution reflects a deeper trend toward digital-first retail that will continue to influence how taco trucks design, price, and present their offerings in the years ahead. External resource: https://www.federalreserve.gov/publications/2024-report-on-the-use-of-electronic-payments.htm

Card Acceptance as a Catalyst for Small-Taco-Truck Economics: Efficiency, Risk, and Growth

A shift is quietly reshaping the street-side food economy, and it centers on how customers pay. For decades, many taco trucks operated on a cash-only model that matched tight margins with the unpredictability of daily sales. A brisk walk past a popular truck in a growing city often reveals a small sign near the window: “We Accept Cards.” This sign is less a gimmick than a signal of a broader economic shift. Card acceptance is not merely a convenience; it is a lever that can alter the arithmetic of the operation. The economics of small, independent food trucks hinge on throughput, risk management, and the agility to adapt to a rapidly digitizing consumer landscape. When cards—and by extension, digital wallets—enter the equation, they quietly redraw the cost-benefit map for operators who learned to live with the friction of cash handling, the risk of theft, and the constant task of cash storage and reconciliation.

The financial logic behind accepting cards rests on several intertwined factors. First is the reduction of cash handling costs and risk. Cash is not free; it demands secure storage, frequent transport to a bank, and meticulous accounting to prevent shrinkage. In a high-throughput setting, even small savings on every sale compound into meaningful gains. Card payments, especially contactless and mobile wallet options, streamline the checkout process. The faster a customer pays, the quicker the line moves, and the more a truck can serve during peak lunch hours or festival crowds. Faster throughput translates directly into higher daily sales volume and improved customer throughput—a critical advantage for operators who cook and plate on the fly and rely on speed to maintain profitability during busy windows.

Yet the cost side cannot be ignored. Card processing fees, scheme charges, and hardware costs sit on the balance sheet of the small operator. While large chains negotiate favorable rates through their scale, independent trucks must navigate a patchwork of processors, terminal costs, and potential per-transaction fees that can nibble away at margins. The economics become especially nuanced when transactions happen in low-dollar ranges, where even modest fees can erode profitability if not offset by increased volume. The practical lesson for operators is to view card acceptance not as a default but as a calculated investment. A simple reader and a reliable internet connection can open the door to new customers, but the decision must be backed by an adoption plan that accounts for variable costs and anticipated uplift in sales.

In addition to the bare arithmetic of fees and throughput, there is a strategic consumer behavior component. In urban markets and on delivery platforms, customers increasingly expect to pay with cards. The convenience factor matters, especially for younger, digitally fluent diners who favor speed and touch-free experiences. When a truck offers multiple payment options, it sends a signal of reliability and modernity. This can boost order frequency, particularly for first-time customers who might be on their way to a worksite or a campus where cash access is less convenient. The broader implication is that card acceptance can help flatten seasonal variability by stabilizing daily sales through a more predictable payment method. In a field characterized by thin margins and fluctuating demand, even modest, incremental gains in average order value or transaction speed become strategically meaningful.

The adoption pattern across the taco-truck ecosystem often mirrors the evolution we see in larger cities and on delivery platforms. In many places, trucks that participate in digital delivery ecosystems can rely on card payments as a default. Platforms designed to connect buyers with meals have ingrained card-based workflows, which reduces friction for the customer and, by extension, increases conversion rates for the truck. It is not merely about having a card reader; it is about ensuring the entire payment experience—from the moment a customer selects an item to the moment funds settle—works smoothly. This is where the signs of “We Accept Cards” and the use of mobile payment rails come into play. They are not cosmetic. They reflect a recognition that payment technology is a strategic asset, not a compliance checkbox.

From a business development perspective, card acceptance enables opportunities beyond simply processing transactions. Digital payment ecosystems allow for the collection of non-sensitive customer data that, when handled responsibly, can support loyalty initiatives and targeted marketing. While a single cash sale is a standalone event, a card-enabled transaction can be a touch point that nudges a customer toward repeat visits. The potential becomes even more compelling when operators consider digital gift cards and loyalty programs. While the specifics of any one brand’s loyalty architecture are beyond the scope of a single truck, the broader pattern is clear: digital payment platforms, paired with loyalty and gift-card infrastructure, create a pathway to sustained customer relationships and recurring revenue.

Recent analyses from 2026 highlight how larger brands leverage payment technology to enhance customer experience and loyalty through digital gift cards and instant-value delivery. Although small operators do not replicate these brands wholesale, the blueprint is instructive: rapid, flexible payment capabilities paired with simple, scalable loyalty tools can unlock repeat business and higher lifetime value per customer. The takeaway for small operators is not to imitate a brand, but to translate the underlying economics into a practical approach: adopt card acceptance with a plan for loyalty and ongoing customer engagement that aligns with local tastes and neighborhood dynamics. A careful integration strategy can avoid the pitfalls of overcomplication while capturing the revenue upside that card payments can unlock.

Operationalizing these ideas does not require a grand, single-technology overhaul. It begins with a thoughtful choice of payment rails and hardware that fit a mobile, often outdoor, environment. A dependable card reader that can operate with intermittent connectivity, a compact point-of-sale interface that can be cleaned and transported with the truck, and a process for handling refunds or voids quickly and transparently are all essential. Beyond hardware, there is the human element: staff trained to explain payment options succinctly, to troubleshoot basic issues on the spot, and to maintain a professional demeanor that reinforces trust with customers. These elements—speed, reliability, and customer confidence—are the invisible drivers behind the visible effect of resonance with today’s consumer expectations. When customers experience a smooth, efficient checkout, they are more likely to complete the purchase and, crucially, to revisit in the future.

The social and economic implications reach beyond the stall window. By embracing card payments, small operators participate more fully in the digital economy, which can also influence how they manage cash flow, taxes, and regulatory compliance. Governments and tax authorities increasingly recognize the value of a transparent, traceable payment stream. While supportive fiscal frameworks can reduce compliance burdens for small operators, they also emphasize the importance of keeping accurate records in a digital environment where sales data can be analyzed for patterns, promotions, and inventory management. The result is a more resilient business model capable of weathering shocks, from supply shifts to shifting consumer preferences. The synergy between payment acceptance and operational discipline can, over time, yield sustainable growth rather than a fleeting boost in sales.

As suggested by the broader literature on small-truck economics, integration of card payment systems can also push operators toward more professional decision-making. The option to link digital payments with inventory management, for instance, offers a clearer view of which menu items move fastest and which remain steady. When a truck can track popular combos and adjust preparation times accordingly, it reduces waste and improves throughput. This is the kind of systemic improvement that does not merely add convenience; it reshapes the entire workflow in a way that makes a small business more scalable. The practical takeaway for operators is not to chase every new payment feature, but to design a lean, resilient payment strategy anchored in reliable hardware, predictable fees, and a clear plan for using data to inform operations.

For readers who want to explore related best practices, there is value in examining how other mobile-food businesses are integrating sustainability with digital payments. A resource focused on sustainable practices for mobile food trucks offers useful perspectives on how cash handling reduction, efficient queuing, and streamlined service fit into a broader environmental and operational strategy. sustainable practices for mobile food trucks This linkage helps situate the discussion within a framework that prioritizes efficiency and responsibility without sacrificing customer experience. The chapter avoids overloading readers with complexity; instead, it points toward practical steps and a mindset oriented toward steady, scalable growth.

Looking ahead, the central question remains whether a particular taco truck should pursue card acceptance as a standard practice. The answer is highly contextual, shaped by local demand, the scale of operations, and the operator’s willingness to invest in a streamlined payment experience. The conversations around card acceptance are not just about technology; they are about how a small business positions itself within a rapidly digitizing ecosystem. The signs at the window, the speed of the checkout, and the ability to offer loyalty perks all contribute to a narrative of reliability and forward-looking thinking. In markets where delivery platforms expand access and reach, card acceptance becomes less a luxury and more a requirement for staying competitive. The economics of the choice, when viewed through the lens of throughput, risk management, and customer engagement, favor operators who adopt a deliberate, data-informed payment strategy that aligns with their neighborhood, their brand, and their growth trajectory.

External resource for broader context on digital gift-card ecosystems used by large brands in payment programs: https://www.tacobell.com/gift-cards

Chapter 3: Do Taco Trucks Take Card? How Digital Payments Are Redefining the Taco Truck Experience

The simple question of whether taco trucks take card is a window into a broader shift in street-food economics. Many operators began cash-only out of necessity, but more trucks now install and accept card readers, enabling contactless payments and digital receipts. This evolution improves speed, accuracy, and cash flow while expanding access for customers who prefer not to carry cash. Still, many smaller outfits remain cash-forward due to costs, maintenance, and concerns about data handling. Yet momentum toward digital payments is growing, especially in dense urban areas and within shared realities like food halls and delivery networks. For travelers, the key is to verify payment methods before you order—signs that say We Accept Cards or visible card-readers can help, but the most reliable source is the truck’s own page or app listing. In sum, card payments are becoming a baseline expectation in many taco-truck ecosystems, not a niche upgrade.

Cash, Cards, and Culture: How Geography Shapes Card Acceptance at Taco Trucks

Taco trucks occupy a nimble space between tradition and technology, where the simple act of paying can reveal larger stories about place, people, and price. The question of whether these mobile kitchens take cards isn’t a binary yes or no; it’s a spectrum, colored by geography, vendor policy, and the rhythms of daily life. The oldest habit—handing over cash—persists where transaction fees are a burden and speed at the window is paramount. In many family‑run setups, cash remains the practical choice because it keeps the line moving and avoids the tiny costs that come with card processing. Yet in urban clusters with dense foot traffic and tech‑savvy customers, many operators have added card readers to their setup. The result is not merely convenience; it’s a shift in how curbside dining is experienced, especially during lunch rushes or late‑night hops when a digital wallet is the easiest way to pay after a long day on the street.

In large, dynamic markets—cities where street food has become a fixture of daily life—taco trucks increasingly equip portable card readers. They connect to smartphones or tablets and support debit and credit payments as well as digital wallets. The logic is straightforward: card payments reduce cash handling, speed up transactions, and appeal to customers who carry little cash or who prefer contactless options. This transition is often visible on the truck’s signage, where a simple We Accept Cards or a digital tap‑to‑pay icon signals that a customer can pay with a breeze, even during a crowded festival or a weeknight feeding frenzy. The impact goes beyond speed. Card acceptance can expand a vendor’s pool of customers, improve reliability during inclement weather when cash drawers might be prone to spills, and align the street‑food experience with the broader ecosystem of urban retail that customers navigate with a tap of their phone.

However, the geography of card acceptance does not follow a universal map. In rural or less developed regions, many operators continue to rely on cash for practical reasons. Widespread internet service and stable electrical supply are not guarantees in every town, and some trucks operate with limited connectivity. The risk of a failed transaction or delayed payment can be enough to deter a hurried customer who is already juggling multiple orders and a long line. In these environments, cash is not merely a payment method; it is a reliable modality that does not depend on blue screens, signal bars, or battery life. Moreover, there are communities where banking access remains uneven. People who are unbanked or underbanked may rely on cash out of necessity, and such realities shape both vendor habits and customer expectations. The cash‑first approach, then, becomes a form of social infrastructure that sustains everyday commerce where digital channels are imperfect or unavailable.

The cultural dimension adds another layer of nuance. In places where cash has long been the dominant exchange, the ritual of exchanging coins or bills at a busy window is part of the urban texture. Paying with cash can feel natural, immediate, and even communal, as a brisk exchange and a tip tucked into a palm carry social meaning. As infrastructure and inclusion improve, communities often open doors to card acceptance, widening access to a street‑food culture for people who travel with cards or digital wallets. Yet the shift is not uniform. In some communities, even younger customers continue to favor cash, either by habit or due to concerns about fees and privacy. This creates a feedback loop: when a truck chooses cash only, it reinforces cash‑preference among customers who might otherwise pay digitally. The landscape, therefore, is a mosaic rather than a straight line from cash to card.

For the traveling eater, the implications are practical and personal. A long drive to a beloved truck can end in disappointment if the vendor requires cash only for certain hours or shifts. The prudent traveler checks ahead, either by scanning the truck’s social pages or by looking up its listing on a delivery‑app aggregator that thoughtfully lists accepted payment methods. A quick glance at the stall window can also reveal the options, with clear lettering or icons indicating whether cards or cash are accepted. In a city where the street‑food scene moves with speed, these signals save time, prevent frustration, and keep the experience enjoyable rather than a scavenger hunt for change. This is not merely about payment flexibility; it is about respecting the customer’s plan and prioritizing a smooth, efficient bite on a busy day.

The rise of digital payments among taco trucks is also intertwined with the broader evolution of delivery platforms and online ordering. In high‑traffic neighborhoods, many trucks partner with delivery apps that aggregate menus and handle payments online. For customers, the convenience of ordering ahead and paying by card reduces the friction of peak times and crowded windows. For operators, online payments can streamline inventory, forecasting, and order accuracy, while also expanding access to a wider customer base that might not carry cash or coins. The alignment of platform logistics with card acceptance isn’t merely a feature; it shifts expectations and redefines what customers consider a reliable, accessible street‑food option. The net effect is a more inclusive dining experience that still honors the immediacy and charm of buying from a curbside kitchen.

On the hardware side, the technology behind card processing at taco trucks has matured to emphasize speed, reliability, and resilience. Portable readers are designed to work even with sporadic connectivity, syncing when a signal returns. This is crucial for trucks that operate along routes with variable coverage or in neighborhoods where power and data signals can dip in the late afternoon sun. The economic calculus for operators weighs processing fees against potential gains from opening up to customers who do not carry cash. Many vendors find that the incremental revenue from card transactions, especially during busy periods, justifies the investment in portable technology and the training to use it efficiently. The result is a curbside experience that feels modern and inclusive without sacrificing the immediacy that makes street food so appealing.

In Austin, the city is highlighted for its vibrant food‑truck culture and the movement toward digital payments is particularly pronounced. Local customers—residents and visitors alike—expect flexible payment options and rapidly accessible service. Trucks frequently announce accepted methods in legible signage and pair those methods with mobile payment options that integrate with their own processing flow. The net effect is a smoother exchange at a window that can be cramped or hot, a moment when a customer taps a card and the line advances with minimal delay. This example illustrates a broader trend: when urban economies foster convenience and accessibility, card acceptance becomes less of a niche capability and more of an operational standard that supports growth and consistency across the street‑food landscape.

What these patterns imply, in practical terms, is that card acceptance among taco trucks is a fluid, location‑sensitive phenomenon. In metropolitan cores, card payments often accompany high foot traffic, proximity to mixed‑use development, and a customer base comfortable with digital wallets. In rural corridors, the absence of reliable networks, the costs associated with card processing, and the presence of unbanked consumers can keep cash as the dominant option. Both sides share a common thread: payment methods reflect the underlying social and economic fabric of a place. And for vendors, the question evolves from a simple capability to a strategic consideration about accessibility, speed, and relationships with the communities they serve. A cash‑first practice may prioritize liquidity and simplicity, while card acceptance can broaden the customer base, reduce cash handling risks, and improve the efficiency of service—provided the network is stable and the fees are manageable.

For readers navigating this geography, the takeaway is not a universal rule but a practical approach: verify ahead, observe the signage, and consider the broader context of the stall’s location. If you’re visiting a truck in a dense city, you’ll likely find card readers or digital‑wallet options. If you’re in a small town or a remote area, carrying a modest amount of cash is sensible. And for those curious about the environmental and operational implications of how these trucks manage payments, a broader perspective on mobile‑food‑truck sustainability and practices can be found here: https://pockettacotruck.com/sustainable-practices-mobile-food-trucks/. This reference helps connect the dots between payment methods, customer expectations, and the day‑to‑day realities of running a mobile food business in diverse settings.

As the chapter moves forward, the discussion will continue to explore how these payment variations influence consumer expectations and vendor strategies across regional markets. The conversation will also consider how the rhythm of street‑food life shapes and is shaped by evolving payment ecosystems, ensuring that the taco truck experience remains accessible, efficient, and memorable in cities, towns, and beyond.

Card by Card: The Evolving Payments Landscape for Taco Trucks and the Drive Toward Inclusive Urban Food Access

The question of whether taco trucks take card is more than a trivia item for late-night cravings. It serves as a lens into how urban economies adapt to technology, how businesses of varying sizes compete for customers, and how city policy frames access to essential, affordable food. In this chapter, payment methods are not treated as mere transactions but as indicators of who can participate in street-level commerce, how data flows from the point of sale, and how public space is negotiated in a modern economy. The trend line is clear: cash remains a stubborn foothold for many small, independent taco trucks, yet a growing cohort of mobile vendors in larger cities are experimenting with digital payments. They deploy compact, mobile point-of-sale systems that accept debit and credit cards, enabling faster service, reducing the friction of change-making, and opening doors to customers who prefer plastic or digital wallets over cash. The phenomenon intersects with delivery platforms and the broader ecosystem of on-demand food, where readers on a screen can complete a purchase in moments and have a warm tortilla ready shortly thereafter. This evolution is not purely technical; it reflects shifting expectations around convenience, accessibility, and the rhythms of urban life. A 2025 overview from the Denver area underscored a widening embrace of card payments among top-rated food trucks, highlighting that the change often comes via lightweight, affordable payment setups that can be transported to a busy street corner or a festival lineup. The evidence is consistent across cities: when a truck can accept a card, lines shorten, complaints about exact change decrease, and the business can collect richer data on what sells, when, and to whom. In practice, acceptance of electronic payments is not a universal rule but a growing standard, particularly where trucks partner with broader delivery networks or operate in districts with heavy foot traffic and tourism. The practical implication is straightforward: card acceptance reduces friction and expands reach, but it does not automatically erase the stubborn realities of cash reliance for many small operators who face costs, reliability concerns, and the learning curve of new technology. The conversation around payment methods thus sits at the intersection of customer experience and vendor viability, at the heart of the urban-food-economy discourse.

Yet the real-world implications extend beyond speed and convenience. The cash-versus-card debate reveals a broader social question: who is included in the urban food economy and who remains outside it because payment options assume access to bank accounts or digital wallets. An illustrative anecdote from micro-mobility and street-food circles tells of a long-standing policy in which a small but persistent cash-only stance excluded lower-income customers or unbanked residents who cannot access traditional banking services. These stories have catalyzed discussions in city halls about whether electronic payment options should be mandated for city-licensed food ventures, and if so, how to implement such mandates without smothering small operators with fees or compliance burdens. The policy conversations in cities like Los Angeles and Chicago offer signposts for how municipalities balance innovation with equity. They explore whether a phased approach, with exemptions for very small vendors or those facing high upfront costs, could ensure inclusive access while still nudging the market toward digital payments. The core policy question becomes how to design rules that preserve the nimbleness of street commerce while safeguarding the right of all residents to access affordable, nourishing food in public space.

Technology adoption and consumer behavior reinforce this trajectory. As devices become cheaper and more compact, and as contactless payment becomes a standard expectation, digital options move from novelty to norm. A 2026 etiquette guide even suggests that digital tipping prompts are becoming a regular feature of everyday transactions, signaling how cultural norms adapt to the digitized labor of street-food workers. The broader takeaway is that the shift to card-enabled operations is not only about cutting through lines; it is also about acknowledging and valuing the labor embedded in street food economies. The move toward digital payments is thus framed not merely as a technical upgrade but as a social project that connects access to urban belonging with the ability to participate in the city’s evolving marketplace. This framing resonates with scholars who place street vendors within the broader conversation about the right to the city, inclusion, and community formation in public space. In this view, a taco truck that accepts cards participates in a larger movement toward an equitable urban economy where everyone can buy affordable food without barriers that hinge on banking status.

The report of future directions emphasizes two parallel threads. First, expect broader adoption of digital payments as vendors recognize the practical benefits: smoother transactions, more precise accounting, easier cross-sell opportunities, and the potential to tailor services based on purchase data. Second, policy and public-support measures are likely to follow, aiming to preserve options for customers who still rely on cash while easing the transition for small vendors. A pragmatic approach calls for a blended payment environment that keeps cash as an option while expanding access to card-based payments. This can include phased implementations, clear exemptions for very small vendors, and targeted support such as subsidized card-readers and basic training on digital payments and data privacy. In short, the future of taco-truck payments will likely be characterized by gradual, inclusive growth rather than abrupt mandates. The aim is to harmonize customer expectations with vendor realities, ensuring that the mobile food economy remains vibrant and accessible to all.

For researchers and practitioners, the implications extend beyond transaction mechanics. Digitization interacts with urban governance, food access, and the politics of public space. The shift toward card acceptance becomes a case study in how cities mediate inclusivity through everyday commerce. It invites policymakers to consider not just the speed of transactions but the accessibility of the urban food system itself. If a taco truck can reach more customers because it accepts cards, then the street corner becomes a more democratic space for sharing culture, nourishment, and community. The literature on street-food economics, digital payments adoption, and equity frameworks can deepen this analysis by offering comparative perspectives across regions and scales, from neighborhood corners to citywide licensing regimes. The central question remains: how do we design a payment ecosystem that is efficient for business, empowering for workers, and fair for residents who rely on cash or who navigate financial exclusion?

Within this evolving landscape, the chapter recognizes a practical, tangible connection to ongoing conversations about sustainability and equity in mobile food operations. This shift toward digital payments aligns with broader efforts to promote responsible practices on the street, including how vendors manage waste, energy use, and customer outreach. It also highlights the importance of accessible information: customers should be able to check payment options before visiting, just as they would confirm hours or menu items. To support this, vendors can display clear signage about accepted forms of payment and ensure that any digital systems are reliable and secure. The movement toward card-enabled operations should be understood not as a single policy or trend but as part of a larger redesign of how street food functions within the urban economy, how vendors connect with customers, and how cities structure public space to be welcoming to a diverse and dynamic mix of people.

This theme connects with broader discussions about sustainable practices in mobile food operations. It is worth noting that the shift toward digital payments dovetails with practices aimed at reducing waste, streamlining transactions, and enhancing data-driven decision-making for small vendors. For readers seeking a concrete example of how this plays out in the field, a concise, practice-oriented overview of sustainable mobile-truck operations highlights the relevance of flexible payment options as part of a broader strategy for resilience and growth. Sustainable practices for mobile food trucks anchors this idea in a practical frame and invites readers to explore how payment choices intersect with environmental and community objectives.

In closing, the future of taco-truck payments is not a contest between cash and cards but a negotiation that shapes who can participate, how quickly transactions occur, and how the city recognizes street food as a legitimate, inclusive facet of urban life. The ongoing policy conversations, the evolving technology, and the experiences of vendors and customers together sketch a path toward a more accessible and equitable street-food economy. For cities considering cashless mandates or phased adoption, the guiding principle should be clear: maintain multiple payment forms, provide support for small operators, and design rules that reflect the diversity of both vendors and the communities they serve. The story of do taco trucks take card is thus a small, revealing chapter in a larger narrative about urban change, technology, and the ongoing effort to ensure that everyone has a seat at the table of the city’s culinary culture. As the scene evolves, it will be essential to keep listening to customers, vendors, and policymakers alike, and to translate that listening into policies and practices that keep street food affordable, accessible, and vibrant for years to come.

External reference: For additional regional context on how digital payments are shaping truck-based food scenes, see the Austin city blog on discovering the best tacos strictly from food trucks. https://www.austintexas.gov/blog/discover-best-tacos-austin-tx-strictly-food-trucks

Final thoughts

As urban life evolves, the ability for taco trucks to accept card payments signals not just convenience but growth, accessibility, and resilience for small operators. The landscape shows that cash remains common in many family-run trucks, yet the momentum toward card acceptance is clear—driven by city density, delivery platforms, and the demand for quick, predictable checkouts. Operators weigh fees, hardware costs, and settlement times, but the payoff includes faster lines, bigger customer bases, and richer data for decision-making. For urban dwellers and freelancers, knowing whether a truck takes cards reduces planning friction and lets you pivot to nearby options with confidence. Geography, culture, and policy will continue to shape the pace of adoption, but the trend toward a more card-friendly street-food ecosystem appears durable. In other words: do taco trucks take card? In many places they do—and in some, they’re edging closer every season. Check signs, peek at delivery app listings, and you’ll ride smarter toward your next bite.