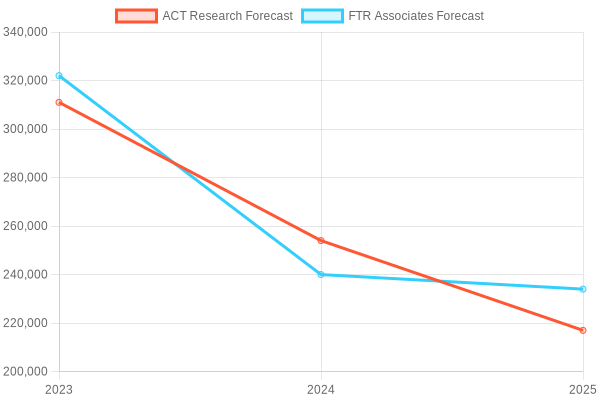

In the current landscape of the trailer market, the lingering impact of weak freight demand is forcing fleets to revise their purchasing and maintenance strategies. With production orders for trailers expected to fall significantly in the coming years—from 314,000 units in 2023 to a forecasted 187,000 in 2025—fleets are confronted with challenging decisions about their operational needs.

The recent economic downturn has led to an observable slowdown in order activity, with a notable 39% drop reported in July alone, leaving trailer manufacturers scrambling to adapt. Tariffs on crucial materials such as steel and aluminum are predicted to inflate van trailer prices by 16-28%, which only adds to the pressure on fleet managers.

Given this complex backdrop, maintaining existing trailers becomes vital, and fleets may need to enhance their maintenance programs to extend the lifespan of their assets. Through careful planning and strategic adjustments, fleets can navigate these turbulent times while ensuring the safety and reliability of their operations.

As the market shifts, the focus on future trailer purchases will necessitate a cautious yet forward-thinking approach to adapt to the new economic reality, ensuring that fleets remain competitive in a tightening market.

| Manufacturer | Production Volume | Pricing Trends | Market Adaptations |

|---|---|---|---|

| Trailcon | 35,000 units/year | Prices rising due to tariffs | Increased focus on maintenance programs |

| Manac | 45,000 units/year | Stable prices with minor fluctuations | Adapting designs for fuel efficiency and durability |

| Fontaine Trailer Company | 50,000 units/year | Prices expected to rise 20% | Implementing more customizable options for fleets |

Economic Factors Affecting Trailer Prices

The trailer market is currently facing several economic challenges that are significantly influencing prices. One key factor is the increase in tariffs on steel and aluminum, which are essential materials for constructing trailers.

Tariffs on Steel and Aluminum

As of June 2025, the U.S. government has doubled tariffs on imported steel and aluminum from 25% to 50%. This decision aims to protect domestic industries but has led to higher raw material costs for manufacturers. According to the U.S. Chamber of Commerce, the average steel price is now around $900 per ton, which is almost double the global average of $450 per ton. Additionally, the price of aluminum has surged because more than half of U.S. aluminum demand is fulfilled by imports, primarily from Canada (U.S. Chamber of Commerce).

Dan Moyer, a senior analyst at FTR, has noted that these tariffs will likely raise production costs for trailer manufacturers, costs that consumers will eventually face. He emphasized, “The impact of these tariffs is extensive; it influences not only the individual components but also the final assembled trailers that enter the market” (Trailer Bodybuilders).

Expected Price Increases

Given the increased costs of raw materials, many experts forecast that trailer prices could rise significantly in the coming years. Expectations suggest potential price hikes of 16% to 28% as manufacturers adapt to these higher expenses. Industry expert John Foss remarked, “I believe this could represent the new reality for trailer pricing.” This shift in pricing will influence fleet managers, who will need to adjust their purchasing strategies in light of these rising costs.

Current Market Conditions

The trailer market has experienced considerable fluctuations in order volumes, complicating price dynamics. For instance, in July 2025, trailer orders saw a 43% decline from the previous month but were still 19% higher than in July 2024. This decrease aligns with a reported contraction in backlogs by 11%, suggesting possible production difficulties ahead (Trailer Bodybuilders).

Alan Briley, a market strategist, advised fleet managers, “My recommendation right now is to not wait too long before reordering,” indicating that prompt ordering could help mitigate future costs and supply chain challenges.

As trailer manufacturers address these economic pressures, adapting production and pricing strategies will be crucial. The ongoing effects of tariffs and uncertainties in the market highlight the need for fleet operators and manufacturers to maintain a cautious yet adaptable approach to navigate this landscape effectively.

The trucking industry demonstrates a strong trend towards adopting maintenance programs, particularly predictive maintenance technologies, which fleet managers are recognizing as essential for economic efficiency. Recent data reveals that approximately 84% of fleet managers are investing in these technologies; this investment leads to significant reductions in maintenance costs of up to 25%. Additionally, 75% of fleet managers benefit from data analytics, contributing to further cost efficiencies.

Structured maintenance programs have proven to be economically advantageous, with ROI reported at 545% within the first operational year for fleets adopting comprehensive strategies. These initiatives help in extending vehicle lifespan by 20% and decrease unscheduled repairs by 1.5 times the industry standard, resulting in reduced downtime costs that generate significant savings annually.

Delay-related costs, particularly from unplanned maintenance, average between $448 and $760 per vehicle each day, while the cost of preventive maintenance services remains comparably low, ranging from $15 to $30 per hour. Furthermore, efficient maintenance scheduling enhances vehicle availability and reduces overall maintenance expenses by as much as 45%. This illustrates how critical maintenance programs are not only for managing fleet operations but also for bolstering economic performance across the trucking sector.

As the trailer market faces considerable pressures from a declining demand and rising regulatory costs, fleets must undertake strategic adaptations to navigate these turbulent waters successfully. The sharp reduction in trailer production orders coupled with the projected price hikes due to tariffs on steel and aluminum require fleet managers to reassess their current operations and future planning. In light of these challenges, prioritizing effective maintenance programs has never been more crucial. By focusing on maintaining and extending the lifespan of existing trailers, fleets can mitigate the financial strains associated with purchasing new units and reduce the risk of unexpected breakdowns that can significantly impact operations.

Furthermore, adopting advanced maintenance strategies such as predictive maintenance not only enhances the safety and reliability of fleet operations but also delivers substantial cost savings. With 84% of fleet managers now investing in these proactive maintenance technologies, the potential for improved operational efficiency is clear. Ultimately, the call to action for fleet managers is to embrace these strategic adaptations, investing time and resources to ensure their fleets are both adaptable to current market conditions and positioned for future success. The pathway to resilience in the trailer market lies in innovation, strategic foresight, and a commitment to robust maintenance practices that safeguard fleet investments and facilitate continuous growth within an unpredictable landscape.

Expert Insights on Trailer Purchases and Maintenance Strategies

Insights from industry experts Dan Moyer and Charles Dutil highlight the significant challenges and strategies facing trailer purchases and maintenance in today’s volatile market. Incorporating advancements in trailer maintenance technology into operational practices is becoming essential for fleet managers, and understanding pricing forecasts is key for future investments.

Dan Moyer’s Insights

- Tariff Impacts on Trailer Costs: Dan Moyer, the Senior Analyst for Commercial Vehicles at FTR, emphasized the profound effects that tariffs have on manufacturing costs. He noted that the recent doubling of tariffs on steel and aluminum imports to 50% has forced manufacturers to make challenging decisions—either absorbing higher costs or passing them onto fleets. This situation has implications for fleet expansion and maintenance decisions. According to Moyer, “The impact of these tariffs is far-reaching; it affects not only the components but the final assembled trailers coming into the market” [source].

- Decline in Trailer Orders: Moyer also reported a sharp decrease in trailer orders, with June 2024 seeing a 17% drop compared to May, totaling just 4,788 units, marking a 71% decrease from the previous year’s monthly average. He expresses concern over what this downturn means for the industry, saying, “Current indicators like orders, cancellations, backlogs, and lead times signal a challenging landscape ahead for trailer demand” [source].

Charles Dutil’s Perspective

- Fleet Purchase Behavior During Economic Downturns: Charles Dutil, CEO of Manac, sheds light on fleet behavior in challenging times, stating that fleets often pause trailer replacements entirely when economic conditions weaken. He explains that a fleet typically replacing 10 to 15 trailers annually might opt out of making any replacements during tough economic times, choosing instead to extend the lifespan of existing trailers [source]. This behavior underlines the importance of innovative trailer maintenance strategies to prolong the effective use of existing assets.

Maintenance Strategies Amid Economic Challenges

- Emphasis on Preventive Maintenance: As new trailer purchases are deferred, the focus intensifies on preventive maintenance strategies that incorporate the latest trailer maintenance technology. Fleets are emphasizing regular inspections, corrosion protection measures, and timely repairs to help aging trailers remain operational and compliant with safety standards [source].

Economic Factors Influencing Fleet Decisions

- Tariff-Induced Cost Increases: Increasing tariffs are predicted to boost van trailer prices by as much as 28%, compelling fleets to hold off on purchases while concentrating on maximizing the utility of existing trailers [source]. The adaptability of fleets through robust maintenance programs can mitigate these financial impacts.

- Fleet Reductions to Align with Demand: To navigate the current market landscape, many carriers have reduced their fleets by an average of 2.2% in 2024, aligning their operations more closely with subdued freight demand [source]. This strategy emphasizes the importance of tailored maintenance programs to extend the life and performance of current assets.

These insights reflect the need for strategic adaptations and robust maintenance practices to successfully mitigate economic pressures within the trailer market. By focusing on trailer maintenance technology and understanding the evolving pricing forecasts, fleet managers can enhance their operational effectiveness and make informed financial decisions.

- Market Decline: Trailer production orders are forecasted to drop to 187,000 units in 2025, down from 230,000 in 2024 and 314,000 in 2023, highlighting a significant downturn in demand.

- Price Increases Due to Tariffs: Fleet managers should anticipate an increase in van trailer prices of 16-28% as a consequence of elevated tariffs on steel and aluminum, which are critical materials for trailer construction.

- Cautious Purchasing Strategies: Experts recommend that fleet managers should not delay in reordering trailers, as suggested by Charles Dutil of Manac, who advised not waiting too long before making new purchases due to anticipated cost increases.

- Emphasis on Maintenance: Maintaining existing trailers is vital in the current climate, urging fleet managers to enhance their maintenance strategies to bolster the lifespan and reliability of assets during economic fluctuations.

- Adopting Predictive Maintenance: Approximately 84% of fleet managers are investing in predictive maintenance technologies, which can lead to a 25% reduction in maintenance costs, thus improving operational efficiency.

- ROI on Maintenance Programs: Structured maintenance initiatives have shown a staggering ROI of 545% within the first year and can extend vehicle lifespan by 20%, underscoring the importance of effective maintenance strategies.

- Flexibility in Operations: Fleet operators must remain adaptable to ongoing economic changes, requiring a shift towards advanced maintenance approaches to mitigate financial strains associated with new trailer purchases.

- Expert Insights: Dan Moyer highlights the pervasive effects of tariffs and market volatility, emphasizing the importance of rapid adaptation and strategic foresight in purchasing and maintenance decisions.

Related Resources for Fleet Managers

Here are several credible resources and articles for fleet managers focusing on trailer purchases, maintenance programs, and economic factors influencing the trailer market:

-

TMC Report on Fleet Owners’ Use and Adoption of Smart Trailer Products & Services

Source: American Trucking Associations

This webinar provides an overview of the Technology & Maintenance Council’s report on the adoption of smart trailer technologies by fleet owners. It covers current technologies offered, brands selected, product performance, customer demand, operational challenges, and future offerings. The session includes insights from industry experts. -

Trailer makers adapt as fleets stall trailer purchases in face of weak freight market

Source: Truck News

This article discusses how trailer manufacturers are adjusting to decreased demand due to a weak freight market. It highlights a 5% decline in order activity and a 39% drop in July orders from June, with van trailer prices expected to rise by 16-28% due to tariffs on steel and aluminum. -

FleetOwner Whitepapers

Source: FleetOwner

FleetOwner offers a collection of whitepapers addressing various aspects of fleet management, including maintenance strategies, cybersecurity, and operational efficiency. Notable titles include “2025 Fleet Cybersecurity Handbook” and “Keep Your Trucks Rolling: A Guide for Trucking Companies Who Want to Maximize Uptime.” -

Trailer Demand & Economic Activity

Source: ACT Research

This report analyzes trailer demand in relation to economic activity, noting that strong demand since 2013 has reduced the average fleet age. The report projects an increase in the trailer-to-tractor ratio and discusses replacement rates and fleet quality metrics. -

Automotive Trailer Market Size, Share | Growth Report [2032]

Source: Fortune Business Insights

This report examines trends in the automotive trailer market, emphasizing the shift towards decarbonization and highlighting California’s mandates for fleets regarding zero-emission trailer technologies.

Future Trends in Trailer Technology

Recent advancements in trailer technology from 2023 to 2025 have significantly transformed fleet operations, focusing on electrification, automation, and smart systems.

Electric Trailers

The integration of electric axles and regenerative braking systems in trailers has gained momentum, complementing the shift toward hybrid and fully electric transport fleets. For instance, ZF’s TrailTrax system combines an electric axle with a battery pack and control unit, enhancing propulsion support and capturing braking energy, leading to substantial fuel savings and emission reductions. source

Smart Trailers and Telematics

The adoption of smart trailers equipped with IoT sensors and AI analytics has become increasingly prevalent. These systems provide real-time data on location, cargo conditions, and trailer health, enabling predictive maintenance and route optimization. Industry projections estimate that by 2026, 1.5 million smart trailers will be operational, with telematics integrated into approximately 70% of new trailers within the next three years. source

Automation and Autonomous Technologies

The development of autonomous trucking technologies has progressed, with companies like Aurora Innovation expanding driverless operations to include night driving and adverse weather conditions. These advancements aim to enhance asset utilization and operational efficiency. source

Impacts on Fleet Operations

The integration of these technologies has led to improved fleet management through enhanced visibility, safety, and regulatory compliance. Connected trailers allow for optimized routes, real-time cargo monitoring, and proactive maintenance scheduling, resulting in cost savings and increased customer satisfaction. source

In summary, the period from 2023 to 2025 has seen significant strides in trailer technology, with electric and smart trailers, along with automation, playing pivotal roles in revolutionizing fleet operations.

| Technology | Description | Benefits/Advantages | Limitations |

|---|---|---|---|

| Vibration Analysis | Uses sensors to detect vibrations to predict failures. | Early fault detection, improved safety | High initial investment |

| Condition Monitoring | Tracks health metrics of components in real-time. | Reduces unplanned downtime, data-driven decisions | Complex implementation and integration |

| Machine Learning Algorithms | Analyzes historical data to predict maintenance needs. | Highly accurate predictions, optimized maintenance schedules | Requires substantial data for training |

| Remote Monitoring Systems | Allows for accessing equipment status remotely. | Increased accessibility, proactive alerts | Dependence on connectivity (internet) |

| IoT Sensors | Connects equipment and machinery to the internet for tracking. | Real-time data visibility, enhanced analytics | Integration costs and cybersecurity risks |

Related Research on Trailer Production and Pricing Strategies

Predictions for Trailer Production

The U.S. trailer industry has experienced notable fluctuations from 2023 through 2025, influenced by various economic factors and market dynamics.

Production Trends:

- 2023: Trailer production in the U.S. was robust, with approximately 324,000 units produced. [TT News]

- 2024: A significant decline occurred, with production dropping to around 223,375 units, marking a 29% decrease from the previous year. This downturn was attributed to a sluggish freight market and reduced demand. [CCJ Digital]

- 2025: Projections indicated a further decline, with production expected to reach approximately 187,000 units. Factors contributing to this trend included ongoing market uncertainties and tariff pressures. [GetTransport]

Market Dynamics:

- Order Trends: In early 2025, despite short-term gains in trailer net orders, long-term demand remained weak due to high-interest rates and a struggling market. January 2025 showed a 51% increase compared to January 2024. [CCJ Digital]

Pricing Strategies Affected by Tariffs

- Price Increases Due to Tariffs: The imposition of tariffs on steel and aluminum has escalated production costs. Dan Moyer estimates that these tariffs could increase the cost of trailers by 16-18%. [CCJ Digital]

- Decline in Trailer Orders: May 2025 saw net trailer orders fell by 34% month-over-month. Cancellations surged, marking the highest rate in a year. [Trailer Bodybuilders]

- Shift Towards Leasing: With rising costs, leasing has become an attractive option, providing flexibility and conserving cash for operators. [DriveWLI]

Tariffs Impacting Trailer Industry in 2025:

- [Trump imposing new 25% large truck tariff starting Nov. 1]

- [US retailers haggle with suppliers after Trump tariffs]

Economic Forecasts for 2025-2030

- Production Forecasts: 2025 is projected to see declines in trailer production, with recovery anticipated starting in 2026, reaching 245,000 units. [Source: ACT Research]

- Market Value and Consumption: The market is expected to grow, reaching $19.7 billion by 2035, indicating a compound annual growth rate of 1.5% from 2024. [IndexBox]

Overall, the U.S. trailer industry is facing a challenging environment characterized by production declines, pricing volatility, and cautious purchasing behavior from fleets. While recovery is expected, it is contingent on improving freight demand and clarity around tariffs.