In the realm of logistics, understanding economic trucking trends is essential for businesses striving to optimize cost management and enhance profitability. Recent reports show that U.S. for-hire truck tonnage has rebounded to its highest levels since December 2023, with a notable 0.9% increase in August. This uptick, however, coexists with a stark decline in the Canadian spot market, where load postings plummeted 14% from July and a staggering 40% year-over-year.

As trade policies and market fluctuations continue to shape the landscape, companies must remain vigilant in tracking these trends to better position themselves amid rising operational costs. The interplay of these factors not only influences shipping rates but also the integrity of supply chains, underscoring the importance of informed decision-making in an ever-evolving economic environment.

Statistics and Trends in the Trucking Markets

Recent statistics reveal impactful trends in both the U.S. and Canadian trucking markets. As we delve into the data, it becomes evident how these numbers not only reflect the current state of the industries but also influence future freight management strategies.

U.S. For-Hire Truck Tonnage

- For-Hire Truck Tonnage Index: The American Trucking Associations have reported fluctuations in the For-Hire Truck Tonnage Index through 2025, illustrating a mix of growth and decline throughout the year:

- January: 111.9 (no change from December)

- February: 115.1 (+2.8% from January)

- March: 113.4 (-1.5% from February)

- April: 113.9 (+0.5% from March)

- May: 113.8 (-0.1% from April)

- July: 116.6 (+1.1% from June)

- August: 115.3 (-0.9% from July)

- September: 114.2 (-0.9% from August)

In summary, the overall index reflects a resilient market that is adapting to seasonal shifts despite recent challenges in growth.

Visual representation of the U.S. For-Hire Truck Tonnage Index showing trends over several months in 2025.

Canadian Load Postings

- Load Postings Decline: In contrast, the Canadian market has observed a notable drop in load postings:

- Outbound Loads: Increased by 41% year-over-year but showed a 14% decline from July.

- Inbound Loads: Experienced a 4% increase year-over-year and surged 88% month-over-month in certain months.

- Truck-to-Load Ratio: Stood at 1.64 trucks per load, signifying tighter competition among carriers.

Implications for the Industry

Both U.S. and Canadian markets are demonstrating critical trends that freight management professionals must acknowledge. The variations in tonnage and load postings can significantly influence shipping rates, operational costs, and overall market competitiveness. Businesses will need to adapt their strategies based on these statistics to maintain efficiency and profitability in the evolving landscape of freight logistics.

The differences in trends also underscore the need for businesses in both markets to closely monitor these metrics, as they are essential for making informed decisions regarding capacity management, pricing strategies, and supply chain forecasting.

Comparison Table of U.S. and Canadian Trucking Markets

| Metric | U.S. Trucking Market | Canadian Trucking Market |

|---|---|---|

| Truck Tonnage | Increased to highest levels since Dec 2023 | Declined significantly |

| Load Postings | Stable with slight fluctuations | Plummeted 14% from July, down 40% YoY |

| Truck-to-Load Ratio | Approximately 4.20 trucks per load | 1.64 trucks per load |

| Year-over-Year Load Growth | Positive changes in some segments | Outbound loads increased 41% |

| Market Challenges | Adapting to seasonal shifts | Ongoing softness in spot market |

This table encapsulates the key metrics that highlight the contrasting dynamics of the trucking markets in the U.S. and Canada. The data indicates that while the U.S. markets are showing signs of recovery and stability, the Canadian market is grappling with significant declines in load postings, impacting overall competitiveness.

Expert Insight on Truck Freight Volumes

Bob Costello, Chief Economist at the American Trucking Associations, highlighted a positive shift in the trucking industry amidst the challenges the market faces. He stated,

“Compared to the high three years earlier, however, truck tonnage is still off by 3.9%.”

This comment underscores that despite the turbulence in the trucking sector, recent data shows progress since the lows observed in January. Costello’s perspective reflects the resilience of the market and the potential for recovery, which is particularly relevant for businesses aiming to navigate through the complexities of freight logistics effectively. The good news indicates that truck freight volumes have experienced upward movement, suggesting a gradual improvement as the economy stabilizes.

This quote not only adds authority to the discussion but also emphasizes the importance of monitoring trucking trends to seize opportunities in an evolving economic climate.

Analyzing Implications for Cost Management in Trucking Trends

Changes in trucking trends play a big role in how businesses manage their costs. Key areas affected include tonnage changes, market conditions, shipping rates, and financial planning. Here are some important points:

1. Tonnage Changes and Market Conditions

- Driver Shortages: The trucking industry is short on drivers. The American Trucking Associations states there is a shortage of over 80,000 drivers in the U.S. This could reach 160,000 by 2030. This lack of drivers means fewer deliveries and higher shipment costs. Source

- Carrier Exits: Many small trucking companies have gone out of business due to rising costs. In recent years, over 88,000 smaller fleets declared bankruptcy, and this trend continues. This reduction can lead to higher shipping prices and less availability. Source

2. Shipping Rates and Financial Planning

- Fuel Price Changes: Fluctuations in fuel prices affect shipping costs directly. In 2024, changes in fuel prices are expected to continue because of global issues and regulations. Businesses should keep an eye on fuel trends and consider potential surcharges in their budgets. Source

- New Regulations: Rules about emissions, safety, and worker practices can influence shipping costs. For example, the Electronic Logging Device (ELD) requirement has impacted driver availability and capacity. Source

- Extended Payment Terms: Shippers are taking longer to pay, stretching payment periods from 30 days to longer. This makes it harder for suppliers and carriers to manage cash flow. Source

3. Strategies for Cost Management

- Long-Term Carrier Contracts: Forming long-term agreements with carriers can help create more predictable prices and service availability. This aids in effective cost control. Source

- Supply Chain Technology: Investing in technology for real-time tracking improves visibility in the supply chain, allowing businesses to respond quickly to disruptions. Source

- Rolling Forecasts: Using rolling forecasts lets businesses adjust their forecasts regularly based on new data so they can respond to market changes better. Source

By understanding and adjusting to these trucking trends, businesses can manage costs more effectively and keep financial stability in a changing market.

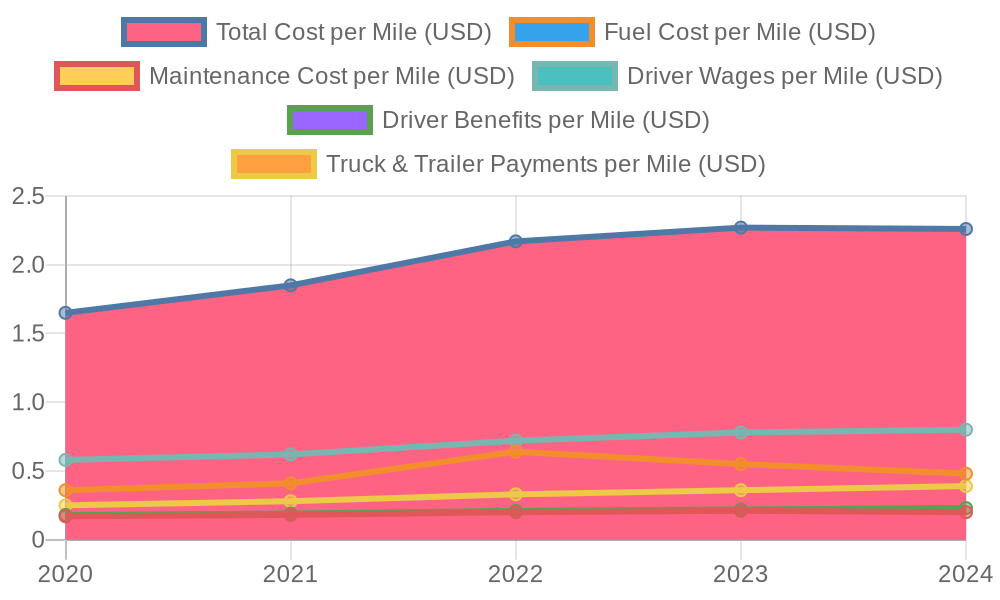

User Adoption Data and Case Studies in Trucking

Trucking companies are actively adopting several strategies to manage costs and improve profitability amidst challenging market conditions. Operational cost management remains paramount, with recent reports indicating that while average operating costs slightly decreased, non-fuel operating costs rose significantly, prompting a focus on reducing these expenses.

Structured fleet management, including regular financial checks and preventive maintenance, has also emerged as a vital strategy, enabling fleets to identify inefficiencies and prolong vehicle lifespans. Furthermore, the integration of technology, such as AI-assisted planning and pricing tools, has proven beneficial for optimizing operations and improving service rates.

Additionally, companies are diversifying their revenue streams by exploring specialized shipping services and strategic partnerships, particularly in e-commerce sectors. Finally, leveraging data analytics facilitates better route optimization and load planning, resulting in lower fuel costs and enhanced delivery efficiency.

Overall, these approaches characterize a proactive response to the operational and financial challenges currently facing the trucking industry.

An illustration representing the upward trend line for U.S. truck tonnage alongside a downward trend line for Canadian load postings.

Conclusion

In summary, navigating the intricacies of the economic trucking landscape requires businesses to maintain a sharp focus on emerging trends and their impact on cost management strategies. The contrasting dynamics between the U.S. and Canadian markets are striking; while U.S. for-hire truck tonnage has shown signs of recovery, the Canadian spot market grapples with significant declines in load postings. Understanding these trends is crucial, as they influence not only operational costs but also strategic decision-making processes.

Companies must remain vigilant and proactive in monitoring key metrics such as the truck-to-load ratio, shipping rates, and industry forecasts. By analyzing and adapting to these economic signals, businesses can better position themselves for profitability and sustainability in a highly competitive environment. The link between awareness of trucking trends and effective strategic planning cannot be overstated; it empowers organizations to make informed decisions, ultimately enhancing their operational resilience in an ever-evolving market.

Future Outlooks for the North American Freight Market

As we look forward to 2026, the North American freight market is poised to experience a myriad of changes prompted by economic factors and shifting trade policies. While the freight sector has shown resilience, several challenges are on the horizon that could redefine operational paradigms.

Impact of Tariffs and Trade Policies

The introduction of new tariffs, such as a 25% levy on heavy-duty truck imports effective October 1, 2025, poses significant implications for manufacturers and freight carriers. These tariffs may increase the costs of trucks and parts, leading to delayed purchases and potentially tighter capacity in the market. The U.S.-Mexico-Canada Agreement (USMCA) will also influence sourcing strategies as manufacturers aim to meet requirements for tariff exemptions, further complicating the landscape.

Economic Shifts

The International Monetary Fund (IMF) projects U.S. economic growth to remain robust at 2.7% for 2025, driven by strong labor markets. However, there are apprehensions regarding protectionism, with a warning about the impacts of tariffs on trade and growth. In addition, forecasts suggest a slowdown in GDP growth, particularly for Canada and Mexico, which could dampen freight demand significantly.

Freight Market Trends

The freight market recovery is anticipated to be gradual, impacted by oversupply and softening demand. While e-commerce continues to rise, accounting for approximately 15% to 16% of all retail sales, traditional freight sectors may face challenges due to manufacturing downturns and shifting consumer spending patterns.

In summary, the North American freight market will continue to navigate through a complex matrix of tariffs, economic fluctuations, and industry trends up to 2026. Stakeholders must remain adaptable and vigilant to manage the challenges that lie ahead, ensuring responsive strategies to capitalize on emerging opportunities.

Graph illustrating the trend of total operating costs in trucking from 2020 to 2024, including components like fuel, maintenance, labor, and truck payments.

In the realm of logistics, understanding economic trucking trends is essential for businesses striving to optimize cost management and enhance profitability. Recent reports show that U.S. for-hire truck tonnage has rebounded to its highest levels since December 2023, with a notable 0.9% increase in August. This uptick, however, coexists with a stark decline in the Canadian spot market, where load postings plummeted 14% from July and a staggering 40% year-over-year. As trade policies and market fluctuations continue to shape the landscape, companies must remain vigilant in tracking these freight trends to better position themselves amid rising operational costs. The interplay of these factors not only influences shipping rates but also the integrity of supply chains, underscoring the importance of informed decision-making in an ever-evolving economic environment, where logistics challenges must be acknowledged.

Statistics and Trends in the Trucking Markets

Recent statistics reveal impactful trends in both the U.S. and Canadian trucking markets. As we delve into the data, it becomes evident how these numbers not only reflect the current state of the industries but also influence future freight management strategies.

U.S. For-Hire Truck Tonnage

- For-Hire Truck Tonnage Index: The American Trucking Associations have reported fluctuations in the For-Hire Truck Tonnage Index through 2025, illustrating a mix of growth and decline throughout the year:

- January: 111.9 (no change from December)

- February: 115.1 (+2.8% from January)

- March: 113.4 (-1.5% from February)

- April: 113.9 (+0.5% from March)

- May: 113.8 (-0.1% from April)

- July: 116.6 (+1.1% from June)

- August: 115.3 (-0.9% from July)

- September: 114.2 (-0.9% from August)

In summary, the overall index reflects a resilient market that is adapting to seasonal shifts despite recent challenges in growth.

Visual representation of the U.S. For-Hire Truck Tonnage Index showing trends over several months in 2025.

Canadian Load Postings

- Load Postings Decline: In contrast, the Canadian market has observed a notable drop in load postings:

- Outbound Loads: Increased by 41% year-over-year but showed a 14% decline from July.

- Inbound Loads: Experienced a 4% increase year-over-year and surged 88% month-over-month in certain months.

- Truck-to-Load Ratio: Stood at 1.64 trucks per load, signifying tighter competition among carriers. Factors like these exemplify ongoing logistics challenges.

Implications for the Industry

Both U.S. and Canadian markets are demonstrating critical trends that freight management professionals must acknowledge. The variations in tonnage and load postings can significantly influence shipping rates, operational costs, and overall market competitiveness. Businesses will need to adapt their strategies based on these statistics to maintain efficiency and profitability in the evolving landscape of freight logistics.